The carbon market is currently one of the key solutions and policies of countries to promote reduction of greenhouse gas emissions. Worldwide, this market is growing rapidly both in terms of transaction market share as well as participating organizations.

Cross-border carbon pricing

According to TASS, in October 10, the World Trade Organization (WTO) established a specialized group to develop a global carbon pricing method. The above move is expected by experts to help countries gradually build their own carbon markets, ensuring fairness in cross-border carbon tax imposition. Also in October 2023, the EU launched the process of imposing a carbon tax on imported goods under the Carbon Border Adjustment Mechanism (CBAM - designed to be compatible with WTO regulations) to prevent "leakage". rust” carbon.

The EU begins piloting the first phase of the CBAM mechanism, from October 1, 10. Accordingly, all goods exported to the EU market of more than 2023 million people will be taxed on carbon based on the intensity of greenhouse gas emissions in the production process in the host country. Initially, CBAM will apply to the import of a number of goods whose production process emits a lot of carbon and has a high risk of carbon "leakage" such as cement, iron and steel, aluminum, fertilizer, and electricity. and hydrogen.

Because it is the world's first carbon tax mechanism for imported goods, CBAM is currently facing some mixed opinions. The Director General of the WTO said that some member countries of this organization view cross-border carbon taxation as a "protection measure". Meanwhile, many countries face difficulties without having carbon pricing tools for exported goods. This is not the first time global carbon pricing has been mentioned. Previously, at the 27th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP27), Canada launched the "Global Carbon Pricing Initiative". Through this initiative, member countries are tasked with exchanging information and sharing experiences to support the implementation of carbon pricing tools, aiming to reduce net emissions to "zero" by year 0.

According to statistics, up to now there have been about 10 countries participating in the above initiative such as Norway, Chile, New Zealand, Denmark, England, Korea and Germany. General Director of the International Monetary Fund (IMF) K.Georgieva emphasized that global carbon pricing is an effective solution, ensuring fairness in responding to the currently complex and unpredictable climate change. now. High-emitting countries must contribute more to the fight against climate change, while developing countries contribute based on their greenhouse gas emissions practices.

Carbon pricing attracts the attention of many countries because it is considered a tool to control environmental pollution and the potential of this market is huge. According to the World Bank (WB), in 2022, countries will collect 95 billion USD in carbon emission fees, a sharp increase compared to 84 billion USD in 2021. Information from Refinitiv Financial Data Analysis Company ( UK) shows that the total value of the global carbon market in 2021 increased to 760 billion euros (nearly 851 billion USD) from 288 billion euros in 2020, an increase of 164%. Growth is largely coming from the Emissions Trading System (EU ETS) – the world's largest and most successful first emissions trading market, accounting for about 90% of the total global emissions market value. European Commission (EC) President Ursula von der Leyen said that the EU ETS has helped reduce the bloc's emissions by 35% since 2005 and generated more than 152 billion euros in revenue. Besides, carbon pricing is also an important tool to help countries balance environmental protection and economic development.

Although it is a goal of many countries and international organizations, global carbon pricing currently faces many challenges. Climate experts say it is necessary to reduce carbon pollution by half in the next 10 years to achieve the goal of limiting global warming and avoiding extreme weather events. However, according to the Director of the Oslo Center for International Climate and Environmental Research (Norway), emissions tend to increase, about 0,5 - 1,5% in 2023 and could reach a record level. new continent. In that context, the development of a global carbon pricing method becomes "more urgent than ever", helping countries accelerate the "green transition" process and reduce greenhouse gas emissions.

Tools to curb CO emissions2

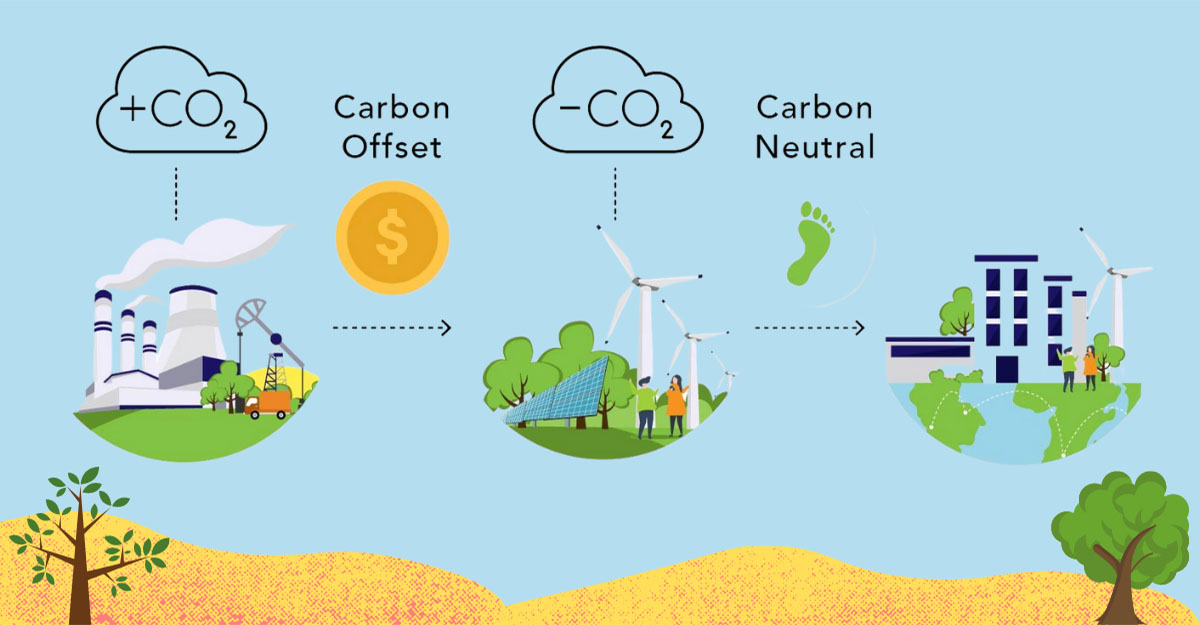

Determining carbon trading is one of the most important tools in reducing emissions. Trading of CO emissions2 on the market is done through “carbon credit” transactions. Carbon credits are the general term for tradable credits or permits representing 1 ton of CO2. Through the carbon credit trading market mechanism, participating parties can effectively and economically reduce greenhouse gas emissions. The principle is that large emitters will pay a fee to receive additional credits and emission quotas to achieve mitigation goals.

Additionally, the operational mechanism for the mandatory carbon market is through the establishment of an Emissions Trading System (ETS). Governments of countries have the function of allocating and selling a limited number of credits and permits to emit a certain amount of carbon (1 ton of CO2) over a period of time. The emitting party only has the right to emit emissions equivalent to the number of credits or permits it owns. Emitting businesses that wish to increase emissions and correspondingly increase production will have to buy credits from parties that wish to resell.

In the EU, the EU ETS is the world's largest multinational carbon trading market, operating on the principle of "cap, trade". Trading of emission quotas and carbon credits is managed according to financial market rules and other relevant laws such as anti-fraud and market transparency. This regulation is necessary to prevent risks of manipulation, insider trading, false information, false rumors... Thereby, ensuring the trading of emission quotas and carbon credits in the market carbon in the EU smoothly, safely, transparently and effectively, enhancing the confidence of subjects in the carbon market.

In China, in 2011, the government launched seven pilot carbon markets. During 7-2013, 2014 carbon markets were tested in 7 cities and 5 provinces with 2 million tons of carbon traded. Each test market is built by linking and coordinating provincial and city agencies and establishing local emissions trading floors. All 57 provinces aim to reduce emissions at factories by about 7-15% in all stages. In 20, China will launch a national carbon market for the power sector, operating based on a “cap and trade” mechanism. China adjusts emission rights based on output, provides quotas based on normal operating levels, depending on the performance of leading enterprises in each sector, and establishes a “Market Reserve Fund”. market" to buy emission rights when there is excess and sell when there is a shortage.

In New Zealand, the country's carbon market has been operating since 2008, covering most sectors of the national economy. The New Zealand government twice reviewed and regulated the carbon market. A special feature of this country's carbon market is that it includes forestry - a sector that mainly absorbs greenhouse gases instead of emitting them. The market operating method is cap and trade. Emission credits or permits will be allocated free of charge or by auction mechanism. The government requires all industries to report annual emissions for purchase or return according to government limits.

In addition, New Zealand also applies fines to organizations that do not fulfill their data collection obligations or intentionally edit reporting information errors. In the first phase, the emissions trading market is built to link with the international carbon market under the Kyoto Protocol. However, since 2015, New Zealand will only focus on the domestic market and credits based on the international market will not be recognized. By 2023, there have been more than 2.360 registered organizations and businesses, accounting for 52% of total national emissions.

The article is sourced from Nhan Dan newspaper: https://nhandan.vn/xay-dung-thi-truong-carbon-toan-cau-post799982.html