Cơ chế điều chỉnh biên giới carbon (CBAM) của EU đã bắt đầu có hiệu lực. Trong khi đó, sản xuất sắt thép là một trong những ngành phát thải nhiều carbon nhất lại thuộc phạm vi cơ chế này. Vậy hoạt động xuất khẩu của các doanh nghiệp ngành thép sẽ bị ảnh hưởng như thế nào và liệu đây có thể là động lực thúc đẩy “xanh hóa” ngành thép Việt cho phù hợp với mục tiêu “Net Zero” trong dài hạn không?

New mechanism reduces carbon emissions

CBAM will aim to impose a carbon tax on all goods imported into EU markets, based on the intensity of greenhouse gas emissions in the production process of the host country. Four commodity groups including: Iron and steel, aluminum, cement and fertilizers exported to the EU by Vietnam will be affected by this mechanism. Of which, iron and steel products account for 96% of the value of these four export items.

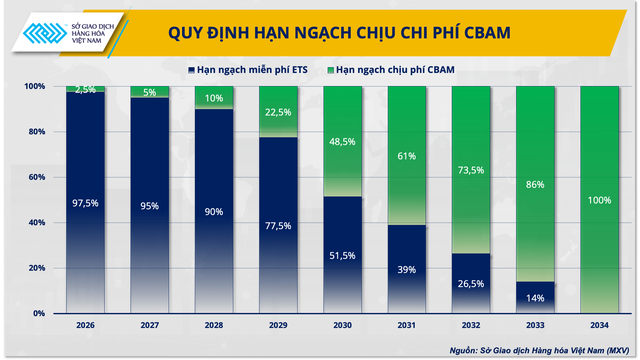

Cơ chế được chia thành 3 giai đoạn. Giai đoạn 1 thí điểm từ tháng 10/2023, áp dụng ban đầu với các hàng hoá nhập khẩu, trong đó có ngành thép. Các doanh nghiệp xuất khẩu giai đoạn này chỉ phải khai báo mức phát thải. Giai đoạn bắt buộc mua chứng chỉ phát thải CBAM và mở rộng ngành hàng sẽ bắt đầu từ sau năm 2026.

According to data from the World Steel Association (WSA), in 2022 alone, the steel industry will generate emissions equivalent to 3,5 billion tons of carbon gas, accounting for about 7-8% of the total greenhouse gases generated globally. bridge. Along with chemicals and cement, iron and steel is one of the three industries with the highest emissions in the world.

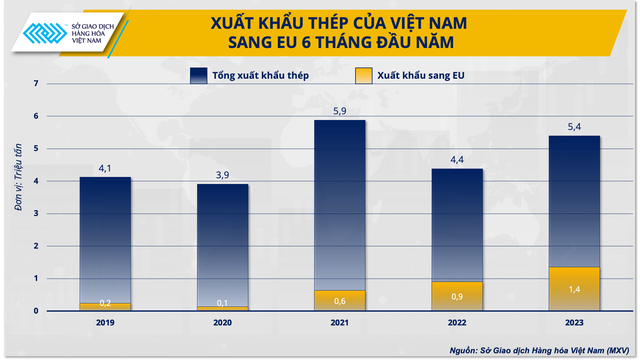

Export steel to EU

After the Vietnam - EU Free Trade Agreement (EVFTA) took effect, Vietnamese steel has continuously expanded its export market share to the EU. The Vietnam Steel Association (VSA) said that in June 6, steel exports to the EU market only accounted for 2020% of total steel export turnover, this number after 3,4 years has increased to 2%, equivalent to corresponding to an increase of more than 20,51 times. Among the four export markets of over 6 billion USD in the steel industry, the EU is the market with a "huge" increase in both volume and value. And about a year after EVFTA took effect, in November 4, for the first time, steel reached the top of items with export value of 1 billion USD. In the first 11 months of this year alone, Vietnam exported more than 2021 million tons of steel to Europe, an increase of nearly 10% over the same period last year and accounting for about 6% of the total steel export structure.

Mr. Pham Quang Anh, Director of Vietnam Commodity News Center, said: "Compared to the period 2019 - 2020 when the export market share to the EU was only about 3-6%, Vietnam's steel industry has had a breakthrough. great in conquering high standard markets. The strong increase in exports partly shows that domestic enterprises have standardized production and taken good advantage of price competition opportunities and EVFTA tariff incentives. However, with the ambition to pioneer in reducing greenhouse gas emissions, the EU market under the CBAM mechanism will pose a bigger challenge for Vietnamese steel exporters."

Export challenges under the CBAM mechanism

According to this mechanism, after the pilot phase, the operational phase from 2026 will force steel importers in the EU to buy CBAM certificates. The price of the certificates will be calculated depending on the weekly average auction price of the EU Emissions Trading System (ETS), expressed in EUR/tonne of CO2 emitted. If Vietnamese steel enterprises do not plan to reduce carbon emissions in production, export products will find it difficult to compete in terms of value.

In addition, procedures and mechanisms related to declaration of emissions information from exporters can also become technical and trade barriers to this market.

According to estimates by the World Trade Organization (WTO), the steel sector is likely to reduce export value by about 4% under the impact of CBAM. Reduced demand leads to a decrease in output of about 0,8%, along with an adverse impact on market competitiveness.

According to VSA's preliminary estimates, CBAM reduces Vietnam's annual GDP by about 100 million USD on average. Although compared to the overall scale of the economy, reaching more than 400 billion USD, this number is not significant. However, similar mechanisms are brewing in many countries such as the US, Australia, Canada... which will have a long-term impact on the whole economy.

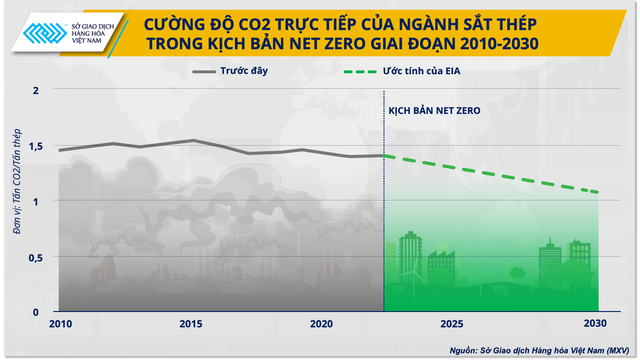

This is a challenge, but also a driving force to push the domestic steel industry towards green production. Currently, there are a number of companies planning to reduce carbon emissions by 50% with some advanced techniques, producing steel with Hydrogen (H2). This is an inevitable long-term trend and is consistent with the Government's Net zero goal.

The driving force to green the steel industry, the inevitable direction of Vietnam

Vietnam is also initially building a carbon neutral roadmap for the steel industry. In particular, the period 2021 - 2025 will optimize processes, energy, raw materials and improve technology to reduce 10-30% of CO2 emissions. The period 2025 - 2030 will use low carbon materials, increasing the amount of H2 gas in sponge iron factories by 30%, in line with world trends.

In addition, the plan to develop the carbon credit market is expected to promote greening momentum in the steel industry in particular and emission-emitting industries in general.

Vietnam Commodity Exchange (MXV) said that it is researching and will soon launch trading of carbon credit products with major exchanges in the world in the fourth quarter of this year. This will be a very important step to gain momentum in the process of developing the carbon credit trading market in Vietnam.

The draft Project "Developing the carbon market in Vietnam" has also been developed on the basis of Decree 06/2022. Accordingly, from now until the end of 2027, Vietnam will focus on building management regulations and exchange activities for greenhouse gas emission quotas and carbon credits. Thereby, it is possible to promote green manufacturing businesses and aim to reduce net emissions to "zero" by 0 according to the general agreement at the COP2050 Conference.

According to CBMA, if EU importers can demonstrate that a carbon price has been paid during the production of imported goods, the corresponding amount can be deducted from the invoice. Non-EU countries with explicit carbon pricing policies, such as carbon taxes or carbon credit markets, may be exempt from CBAM.

“Tác động của CBAM đối với hoạt động xuất khẩu sắt thép của Việt Nam sang thị trường EU rõ ràng là một thách thức không nhỏ, nếu xét về ngắn và trung hạn. Tuy nhiên, về dài hạn, cùng với quá trình chuyển dịch sang nền kinh tế xanh, phát triển năng lượng xanh, sản xuất xanh thì đây là cơ hội cho các doanh nghiệp thép Việt Nam nâng cao chất lượng sản phẩm, đáp ứng tiêu chuẩn quốc tế và phát triển bền vững”, ông Phạm Quang Anh nhận định.

Bài viết được tham khảo từ báo Nhân dân: https://baochinhphu.vn/co-che-cbam-cua-eu-dong-luc-hay-thach-thuc-cho-nganh-sat-thep-102230831152924925.htm